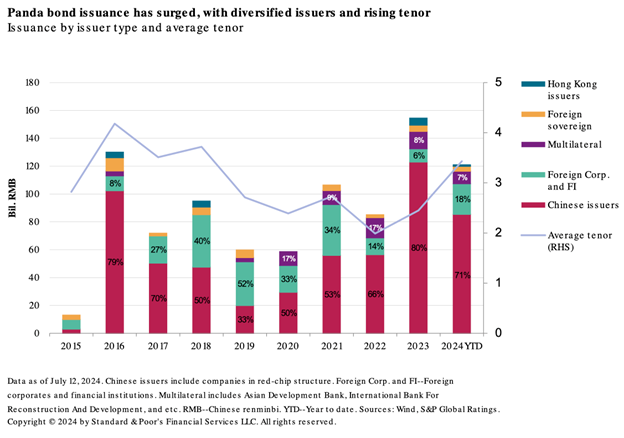

The year 2024 is shaping up to be the best for panda bond issuance since the market opened in 2005. Panda bond issuance rose 82% in 2023 on a year-on-year basis. As of July 12, 2024, panda bond issuance accounted for 78% of the full-year amount issued in 2023.

A panda bond is denominated in Chinese renminbi (RMB) and issued by non-Chinese entities in the China domestic bond market. Chinese-owned entities incorporated outside of mainland China are eligible for issuance. This includes, for example, so-called red-chip companies–those that are incorporated in offshore tax centers such as the Cayman Islands but with businesses based in mainland China.

What’s driving the surge in issuance?

The first of two key drivers is the interest rate differential between China and the U.S. The rise in U.S. interest rates since early 2023 has made it cheaper for entities to issue panda bonds even after considering cross currency swaps cost, rather than directly tapping the dollar market.

The other driver for issuance is the clarification of the use of proceeds. In 2022, the Chinese government issued a policy to clarify that the proceeds from panda bonds can be repatriated offshore. As a result, foreign-owned multinationals have become more active in tapping the panda bond market to raise funds for their expansions in China.

Why does it matter?

The panda bond market could become a meaningful funding channel for non-Chinese entities. At the moment, funds raised from the panda bond market are relatively small. Last year, funds raised from panda bonds accounted for only 0.8% of China’s domestic bond financing (excluding central government and local government bond). The increasing diversity of issuers also adds to the depth and breadth of the China domestic bond market.

Government policies to deepen the bond market and encourage the use of renminbi as a settlement currency could further develop the panda bond market. Foreign investors looking to diversify their currency exposures are also attracted by the low correlation between renminbi bonds and global bonds. Foreign investors own a tiny portion of renminbi-denominated bonds.

The further deepening of the market depends on the issuance of longer tenor debt. The average tenor of panda bond issuance has increased to more than three years from two years in 2022. Also, the quality and diversity of foreign issuers (excluding Chinese-owned entities) would drive the deepening process. Issuance regulation and market transparency could be still hurdles for some issuers.

Currency movement may have a bearing on the cross-border management of proceeds. Doubt remains as to whether the volatility of renminbi exchange rates could occasionally disrupt the ease of repatriation of renminbi proceeds from panda bond issuance to offshore. Renminbi stability has been a key policy objective for the Chinese government.